Good financial practice can determine how far you can reach, as far as saving is concerned. Saving does not only secure you future, it also gives you confidence to live your current life. We all don’t know what the future holds for us thus the best gift we can give ourselves is saving for a better tomorrow.

1. Impulse buying

Impulse purchase or impulse buying is an unplanned decision to buy a product or service, made just before a purchase. One who tends to make such purchases is referred to as an impulse purchaser or impulse buyer. This will always work against your finance goals.

If you want to avoid impulse buying always plan for your budget and set financial goals with well outlined time limit. Avoid holding too much liquid cash or having them in your Mpesa account.

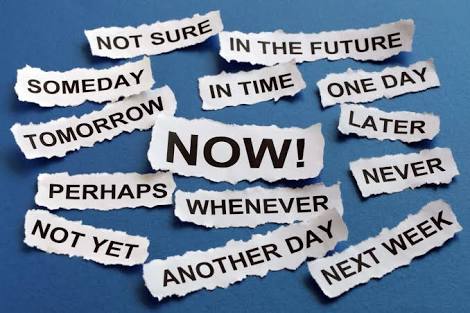

2. Procrastination

This is an act of postponement. If you are that kind of a person of saying that you will start tomorrow then know that your financial growth will be limited. If you want to start saving do today, because tomorrow may never reach.

3. Belittling Insurance

As much the reputation of insurance companies in Kenya is not good, it is always good to remember that the role of insurance in ones financial growth cannot be underestimated. As much as we cannot control all things that happen in our life, what remains is that with insurance, you can reduce the cost misfortunes that happens in our lives.

However, before insuring your property it’s always good to do proper research on which company will work well with you.

4. Not saving for retirement

It doesn’t matter whether you are employed in public or private sector, what you need to know is that if God gives you a long life one day you’ll retire. After retiring you don’t have to start straining financially. The best time to thing about your future is between 20’s and 30’s. This the time you need to work on your retirement saving plan. By so doing your future will wholeheartedly thank you.

5. Ignorance

One can be born ignorant or you can also acquire it from environment. It doesnt matter what’s cause of your ignorance, the truth is that it can negatively impact on financial life. Instead of spending the whole day watching a television or discussing unnecessary political issues you can think of other economic activities.

It will actually be extremely shameful if you hit 50, and all your lifetime you’ve been in a good career, yet you have nothing to show from it. With this generation where digital world is growing day after day, the best thing you can do is get amazing ideas from internet and appropriately work on your life.

Ignorance is costly avoid it as much as you can. With the current digital world, ignorance is a choice.