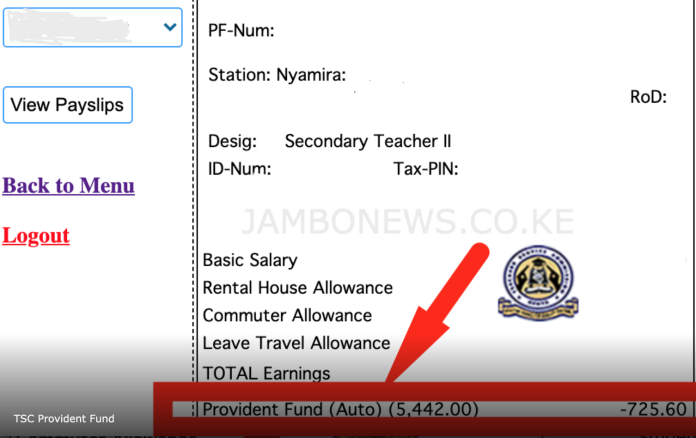

The Teachers Service Commission, TSC, has effected a new deduction on teachers’ payslips that is is inline with the government of Kenya.

The deduction that is dubbed as Provident Fund will see teachers contribute 2 per cent of their monthly salaries towards the new savings scheme.

Literary, Provident fund is another name for pension fund.

The ultimate goal of the deduction is to provide employees with lump sum payments at the time of exit from service. This differs from pension funds, which have elements of both lump sum as well as monthly pension payments. As far as differences between gratuity and provident funds are concerned, although both types involve lump sum payments at the end of employment, pension fund operates as a defined benefit plan, while the Provident fund is a defined contribution plan.

The new contributory pension scheme will see government employees (including teachers) contribute 7.5% of their monthly basic salaries; while the employer tops up with 15% of the employee’s basic salary.

Effecting

To make the burden lighter for teachers, they will contribute only 2% of their basic pay in the first year (2021).

In 2022 (the second year), teachers will contribute 5% of their basic pay while the full 7.5% deduction will be effected as from the third year (2023).

Reprieve

Men have a reprieve, at least for now, as the deduction under the new pension scheme has been taken care of by stoppage of the the Widows and Children’s Pension Scheme (WCPS) contributions.