Today lets focus on how to file KRA returns using a P9 form. All you need know is the process is simple and straightforward.

Requirements for filing KRA Returns for those in Employment

There are three basic requirements that you must have for the process of filing KRA returns through iTax portal to start. All you need to have is KRA PIN Number, iTax Password and KRA P9 Form.

KRA PIN Number

This the most fundamental requirement for the process of filing KRA returns to kick off. This pin can be obtained from your KRA certificate.

iTax Password

This will enable you to log in to your iTax portal. It is important to note that in case you do not remember your iTax password, you can reset it by clicking on Forgot Password/Unlock Account, solve the security stamp question and then click on submit.

Your new password will be sent to the email that you used during registration of KRA.

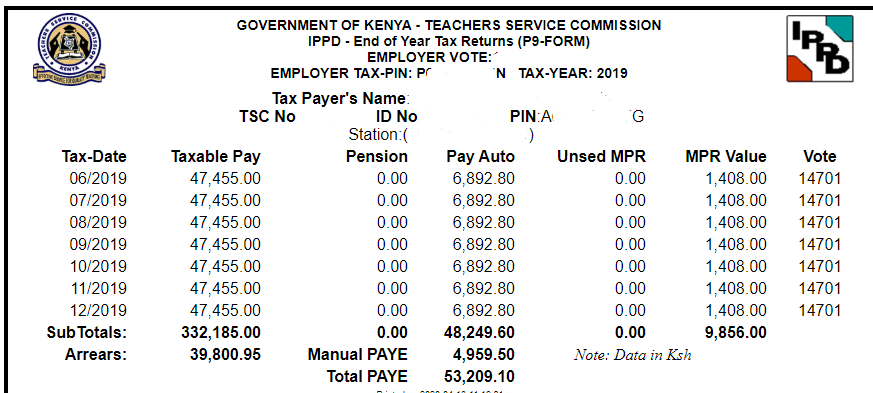

KRA P9 Form

This is a tax deduction form that shows you the Employer Tax-Pin, Gross Pay, Taxable Pay, PAYE and Personal Relief among other details for the respective year whose tax return is to be filed.

How to File KRA Returns using P9 Form

In this post we are going to use the P9 form above. Remember that normally a P9 form should contain data for 12 months, but the one above shows data for only 7 months.

Its important to note that number of months however depends on on the deductions and date of employment.

Step 1: Visit KRA iTax Web Portal using https://itax.kra.go.ke/KRA-Portal/ then login using your KRA PIN number and iTax Password.

Step 2: Once you login to your iTax portal, you will land on a page that looks like the one shown below. Place the cursor on Returns then click on File Returns that will appear on drop down menu.

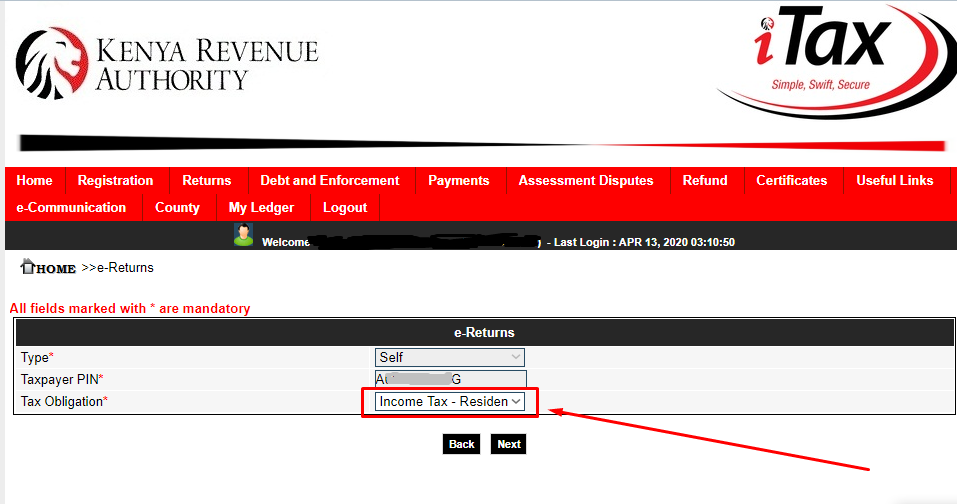

Step 3: You will be taken to a page that looks the one shown below.

Select the tax obligation as Income Tax – Resident Individual since we are filing KRA Returns for Kenyan resident with employment income. Then click on NEXT.

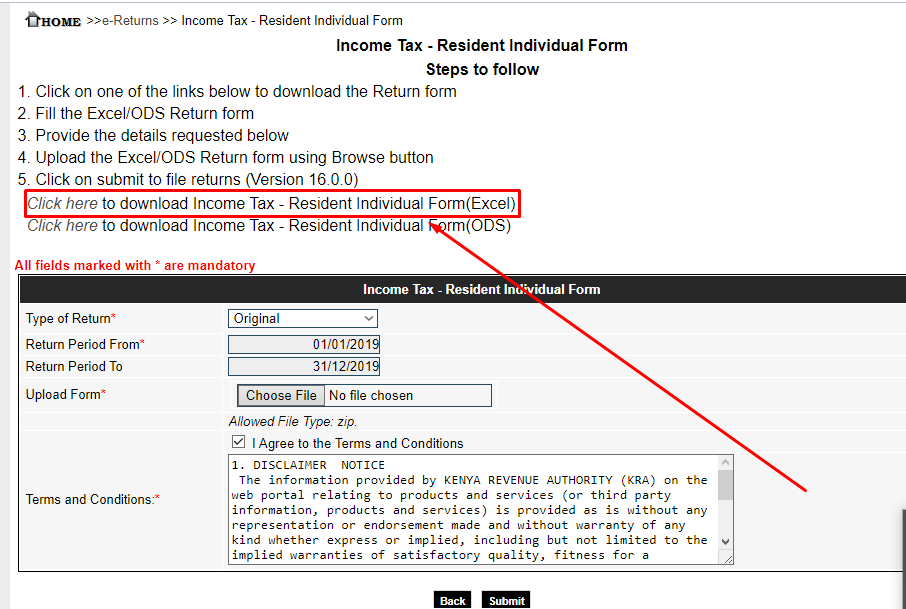

Step 4: This step entails downloading of the Income Tax Resident Individual Form preferably (Excel) as shown below.

Remember that this is a Zipped folder that you will need to Unzip.

Step 5: Once you have downloaded the Income Tax Resident Individual Form, the next thing is to enable Macros on the Excel sheet since by default Macros on the Excel sheet in Microsoft Excel 2007 is disabled.

Step 6: Once the form has been opened in excel you will be required to fill in the following tabs:

- Basic Info

- Employment Income

- Details of PAYE Deducted

- Tax Computation

- Filing Basic Information

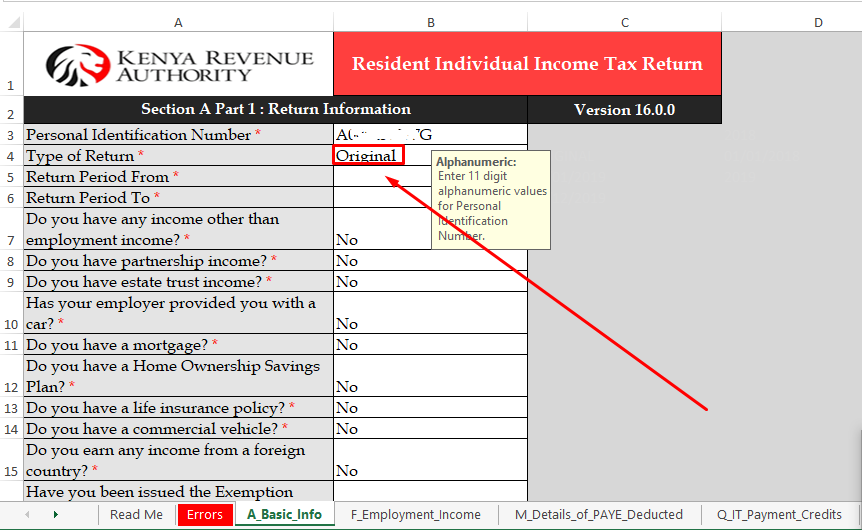

Enter your KRA Pin number(11 digit alphanumeric values) and also select the type of return as Original.

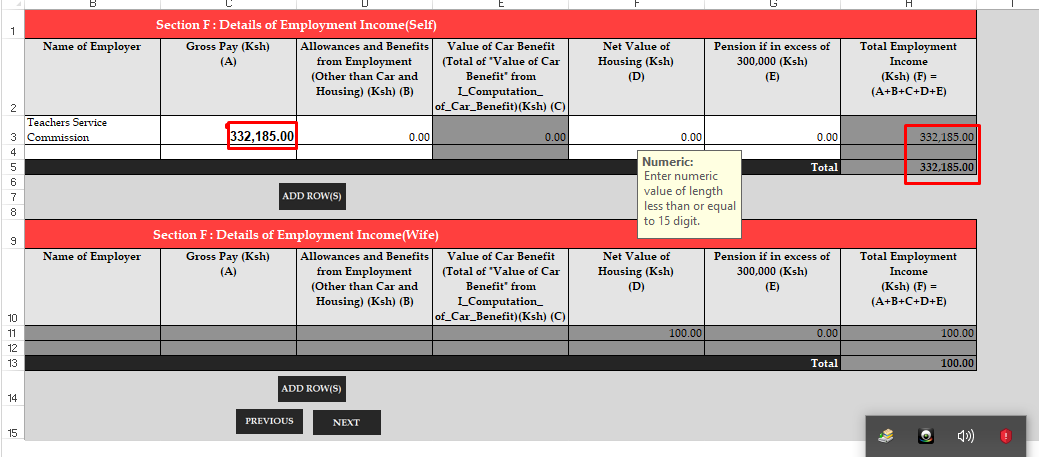

2. Employment Income

In this section, you need to provide Name of Employer and Gross Pay. The other fields just write 0.00 as shown below. Thereafter click on next.

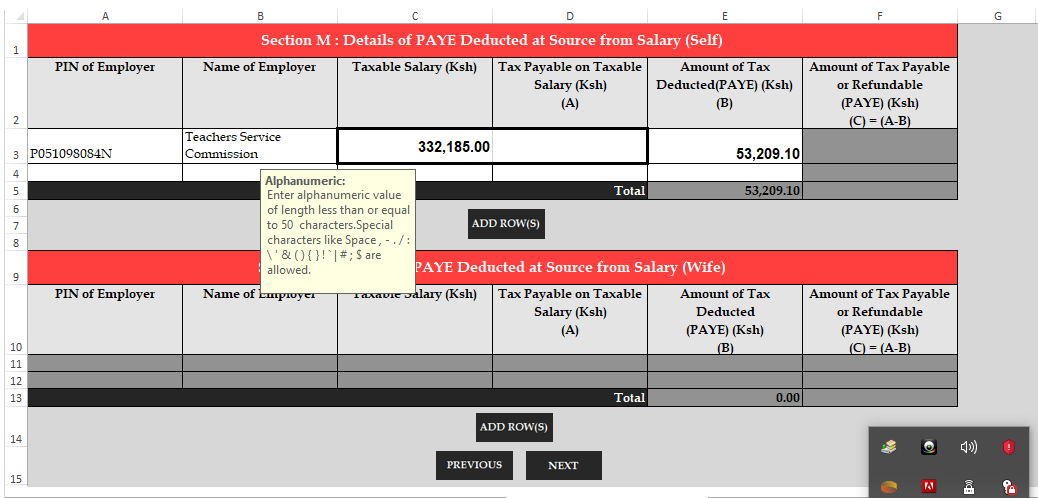

3. Details of PAYE Deducted

In this section, you need to provide PIN of Employer, Name of Employer, Taxable Salary and Amount of Tax Deducted (PAYE) as shown below. Once done click on next.

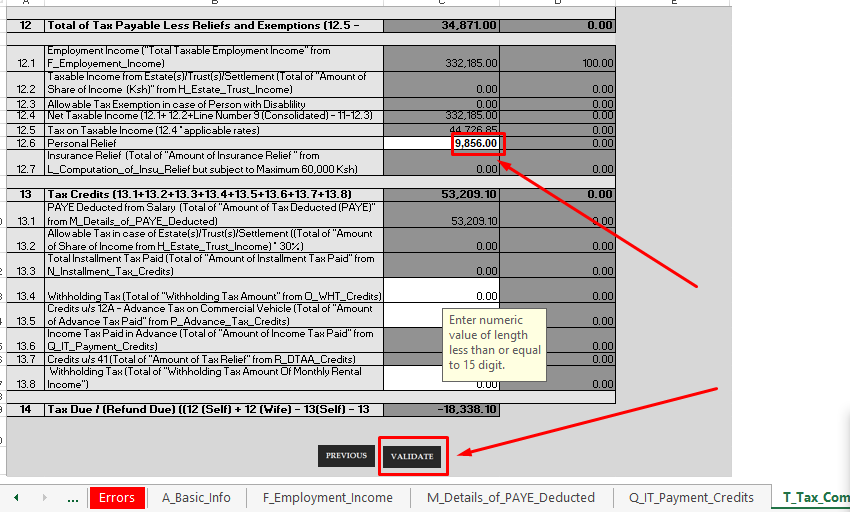

4. Tax Computation

This is the last section. You only need to fill your personal relief. From the p9 form above, personal relief is ksh 9,856.00.

Note 1: A negative figure in your KRA Return means that you are due for a refund from KRA. This therefore means that if your balance is a negative value, you will be required to enter your bank details under basic information.

Note 2: A positive figure in your KRA Return means that you owe KRA.

Once you have filled and confirmed all required data, click on validate as shown above.

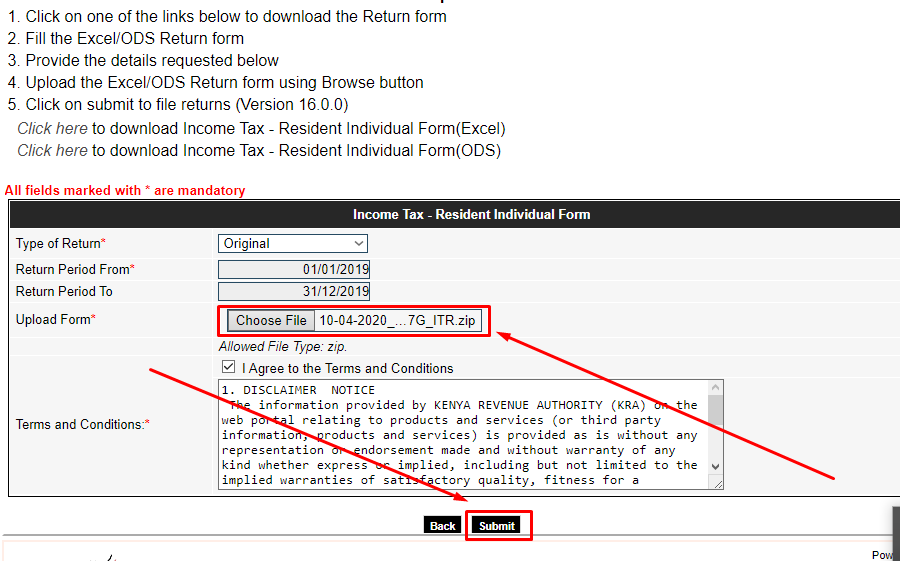

Step 7: Upload Income Tax Resident Individual Excel Form

This step will require you to go back iTax portal and upload Income Tax Individual Excel Form.

Read through terms and conditions and once done tick the box. Finally click on submit button.

Step 8: Finally, print KRA eReturn Acknowledgement Receipt.