The TSC P9 form is a tax returns form that can be accessed through TSC Payslip portal. The form provides crucial information when filing the respective year’s tax returns.

It is an obligation of each teacher file tax returns yearly. Failure to file tax returns is a criminal offence that attracts a huge penalty.

To file the KRA returns, one is supposed to have a P9 form that is generated by the employer.

On April, TSC informed teachers that the Tax deduction cards (P9 Forms) had been uploaded on the payslip portal for all TSC employees to download. This move was to facilitate filing of the returns.

Late filing of tax returns attracts a penalty of 5% of the tax due or Ksh 20,000 whichever is higher. Late payments of taxes leads to a penalty of 20% of the outstanding tax.

How to download and print TSC P9 Form

To download and print TSC P9 form is simple and straightforward. Follow these steps;

- Log in to your tsc payslip portal (https://payslip.tsc.go.ke/login.php) by entering your TSC number and password.

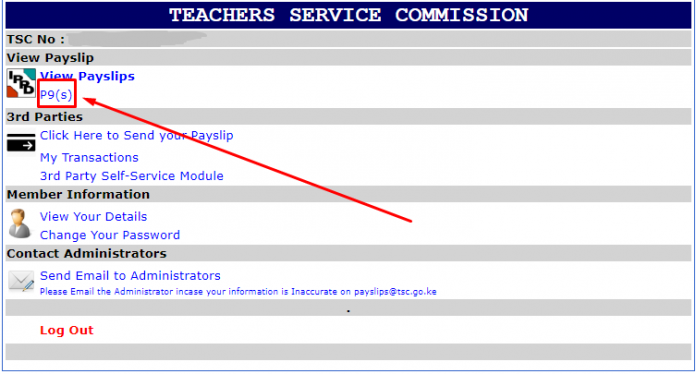

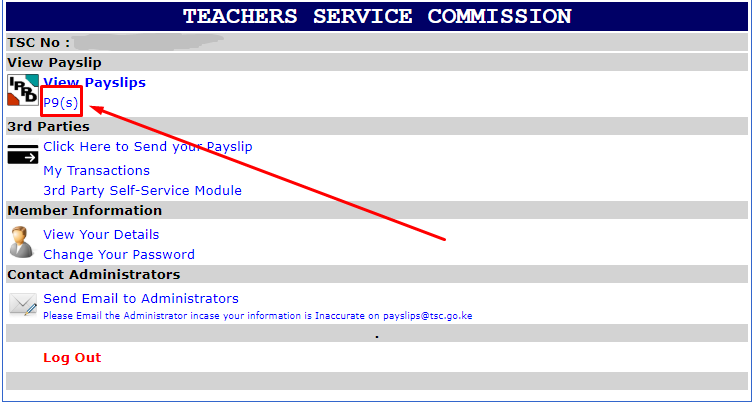

- Once you have logged into your TSC Payslip portal click on P9s as shown below;

- KRA tax PIN,

- Tax year,

- tax payer’s name,

- Employer (TSC) Tax PIN,

- TSC number, ID Number,

- KRA PIN and the teacher’s station code.

- The monthly tax dates (for the whole year),

- Taxable pay (Total gross salary earned by the teacher monthly),

- Pension earned (for retired teachers),

- Amount of PAYE deducted monthly (Pay Auto) and Monthly Relief (MPR).

To file your Tax returns, print the P9 form and use the values on it to declare your returns.