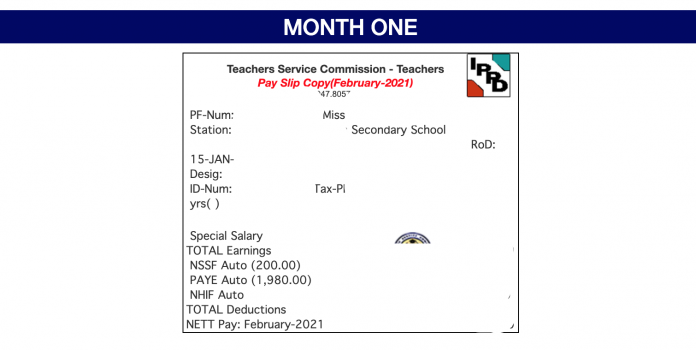

Starting this month of July 2023 teachers employed by TSC faced more deductions in their payslips.

Despite, the salary increment announcement of between 7-10%, more deductions will still dent payslips of teachers.

In this write up am going to give you a sneak peek of deductions teachers’ payslips will face

MANDATORY DEDUCTIONS

1. Pay As You Earn PAYE (30%)

This is one of the mandatory deductions that applies to all teachers. For example a teacher in grade C3 is deducted over kes. 10,000 as PAYE.

Teachers from lowest job group B5 to highest in D5 will face a deduction of 30% of their gross pay going towards tax commonly referred to as PAYE.

2. Provident Fund (7.5%)

This affects teachers aged 45 years and below.

The new contributory pension scheme will see government employees (including teachers) contribute 7.5% of their monthly basic salaries; while the employer tops up with 15% of the employee’s basic salary.

This is a defined contribution pension arrangement where the employee and the employer contribute to fund the scheme to benefit the employees.

One can dial USSD Code *378# and verify account by entering their ID number and creating a password.

Upon verifying the account you will then be able to check provident fund contribution and balance, the beneficiaries and even update there beneficiaries.

3. Knut, Kuppet, Kusnet and Kewota deductions

Union deductions are meant to help unions to run their daily operations.

For primary school teachers, they are deducted 2% of their basic pay towards Knut. Their counterparts in Post primary school teachers (Secondary and tertiary) face 1.8% of basic pay deduction towards Kuppet.

Those teaching in special schools will meet 1.45% of basic pay deduction towards Kusnet. Female teachers will lose sh. 200/- to be channeled to Kewota.

4. Housing fund deduction (1.5%)

This is a newly introduced deduction that is controversial. Initially it started as a tax then latter it camuoflaged into a levy.

Teachers will meet a new deduction on there July payslips. This House Levy will be equivalent to 1.5% of gross pay. The employer will contribute similar percentage.

5. Loan and Premium deductions

This applies to teachers with loans from Banks, Saccos or even Microfinances will find their payslips with deductions going towards servicing the loans.

Some teachers have also invested in insurance companies by taking insurance policies, they will lose the agreed amount to be paid to insurance firms as premium for the policy taken.

6. HELB Loan

This only applies to newly employed teachers who enjoyed the facility in colleges. The lending board usually deduct around kes. 5,000 monthly untill loan is fully paid.

PROPOSED DEDUCTIONS

7. NHIF deduction (2.75%)

This deduction is yet to be effected. It was first proposed by president William Ruto on June 26, 2023, for the National Hospital Insurance Fund (NHIF) to enhance equality in payment.

According to the head of state, Kenyans will pay the national insurer 2.75 per cent of their gross salary.