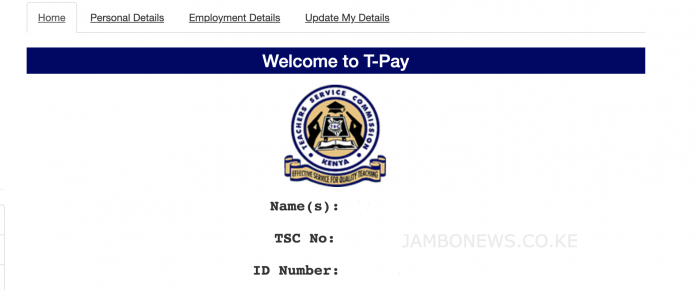

The Commission developed the online T-Pay application platform for employees and Third-party firms to transact check-off deductions. The application has enhanced efficiency in management of Third Party check of facility.

The System further seeks to:-

- Enforce the one third rule as per the provisions of Employment Act (2007).

- Minimize fraudulent transactions through inbuilt controls;

- Empower employees to have control over Third Party deductions against their salary;

- Enable Third Party firms manage their data, minimize data entry errors and enhance accountability on deductions against an employee’s salary;

- Have Real time data capture hence a reduction on transaction turnaround time;

- Reduce operational costs.

The users of online T-Pay application are the employees, the employer and the Third-Party firms.

The obligation of the Employee shall include:-

- To initiate all transactions with the preferred Third Party firm, by sending his/her pay slip online.

- To complete the process by approving the captured transactions to be deducted against his/her salary before they are loaded on payroll.

- To take responsibility and safeguard their online T-Pay system password. 9.4.4 To provide authentic documents when seeking check-off services.

- To read and understand the contract terms and conditions before signing the legally binding contract/agreement with the Third-Party firm.

- To notify the Commission in writing when joining or withdrawing from a third party.

The obligation of the Third-Party firm shall include to:-

- Obtain legitimate authority from employees before transacting any facility in the T-Pay system;

- Capture, adjust and stop all deductions online for the respective employee as per the signed legally bidding agreement/contract between the employee and the firm.

- To upload a soft copy of the contractual agreement at the point of uploading the loan at the T-PAY system

- Safeguard employee’s data and confidential information that it has been entrusted with and use it for only the intended purpose as per the Data Protection Act, 2019.

- Be held accountable for integrity of data captured on the T-pay system. 9.5.6 Submit accurate data to the Commission to facilitate 3rd party deductions;

- Reconcile its deduction requests against the by-products to avoid duplication or double deduction of the same transaction;

- Undertake due diligence to ensure that the documents and data submitted are valid and accurate to facilitate the deductions;

- Return/refund the erroneous or irregular remittances to the Commission upon demand or upon detection of the irregularity;

- Stop deductions for a discharged liability not later than three (3) days from the date of such clearance by the employee;

- Adhere to the Provisions of the Third-party Guidelines.

The obligation of the Commission shall be to:-

- Extract all approved data on T-Pay application, verify the same and upload on the payroll;

- Receive complaints from employees and forward them to human resource management and development directorate for action.

- Stop any unauthorized deduction and inform the relevant third party of the complaint and stoppage of deductions.

- Blacklist and deregister any third party firm and/or entity who has been established to be involved in fraudulent deductions in the T-pay system in accordance with the provisions of the agreement.

- Reduce from the 3rd party’s subsequent monthly remittances any fictitious, inaccurate or irregular deduction erroneously effected on an employee’s salary whether caused by the 3rd party’s negligence or otherwise and refunded to the affected employee;

- The Commission reserves the right to verify and confirm the authenticity and accuracy of any data submitted by 3rd parties before the same is affected on payroll.